The afternoon after the night’s raucous presidential debate has seen US stocks climbing northwards on renewed stimulus optimism. That Democratic challenger Biden ‘survived’ the debate is one takeaway, but transition concerns linger with direct accusations largely outweighing policy discussions, as we wrote this morning.

Economic data has been more encouraging today with Chinese PMIs this morning signalling solid expansion of manufacturing activity as well as the services PMI climbing to the highest level since mid-2012. Notably, new export orders surged with the strongest reading since September 2014.

US employment figures have also been positive with the ADP print of 749k jobs beating expectations of a gain of 600k, with construction and trade transportation leading the gains. The report comes two days ahead of the monthly non-farm payrolls report which is forecast to show growth of 800k in September.

The Dollar is fairly mixed on the day having been bolstered earlier by month-end and quarter-end demand. Nancy Pelosi and Steve Mnuchin are scheduled to meet again today as Democrats look set to schedule a House vote on their $2.2 trillion stimulus proposal.

EUR anxiety building over relief package

The Euro is in the red this afternoon following ECB President Lagarde’s concern about low inflation, which comes amid rising speculation over a rate cut. News of a possible delay in the EU Recovery Fund is also definitely not helping EUR bulls.

After falling out of its eight-week range recently, the recent advances in EUR/USD have been checked around 1.1750. This area has acted as a pivot point and recent support on numerous occasions since mid-July, so now turns into resistance. The world’s most popular pair looks to be well supported above 1.16.

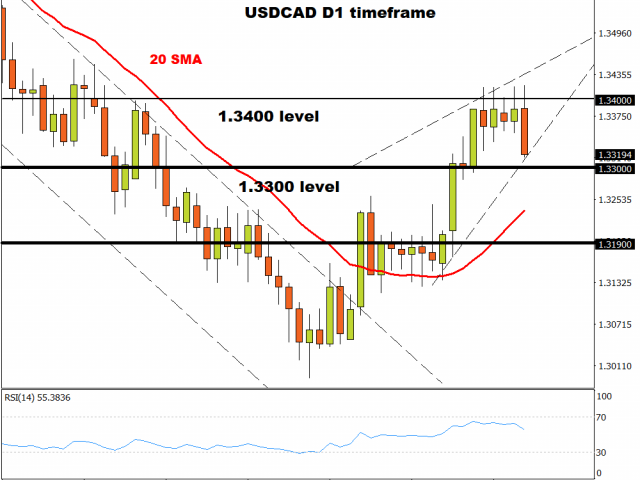

CAD steady and compressing

The monthly Canadian GDP report showed that the economy recorded growth of 3% in July, lower than the previous month’s 6.5% rise but in line with estimates. At the present pace, Canada’s recovery is not lagging its peers, and this should see CAD outperform AUD and NZD, as it has done so far this month.

This, coupled with a modest uptick in crude oil prices, has extended some support to the commodity-linked loonie. The daily chart is seeing USD/CAD tracking sideways with solid selling interest on gains to the 1.34 area. An elongated bullish wedge could be forming which may see prices break above 1.3420 resistance.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經