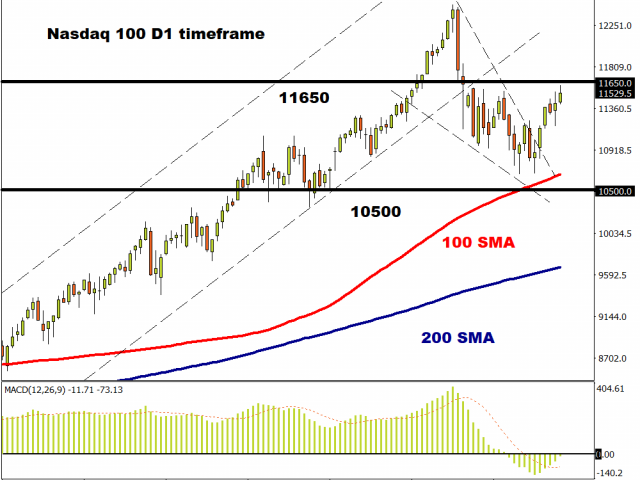

After yesterday’s day of indecision and the printing of a ‘doji’ candlestick, the S&P500 has opened up strongly and is trying to climb beyond Wednesday’s high. Tech seems to be leading the way with the Nasdaq looking like it might be breaking out from resistance around 11,500.

Key once again is the likelihood on whether the Administration and Democrats can bridge the gap between their respective $1.62trn and $2.2trln new stimulus offers, and then ultimately if any agreement can make its way through Congress. Failure to do so really does mean the US will not receive the fiscal boost it needs until after the November election.

The Dollar is starting the new month modestly on the back foot, with today’s price action reinforcing its broader performance to an extent. Risk mood is generally positive with major bond markets softer and the US 30-year Treasury closing in on 1.5%. US initial jobless claims released before the open drifted lower than expected last week and the continuing claims declined as well. That said, the former is still above the 665,000 peak during the 2008 Great Financial Crisis, even if filings have dropped from the record 6.687mn at the end of March.

Brexit Headline Havoc

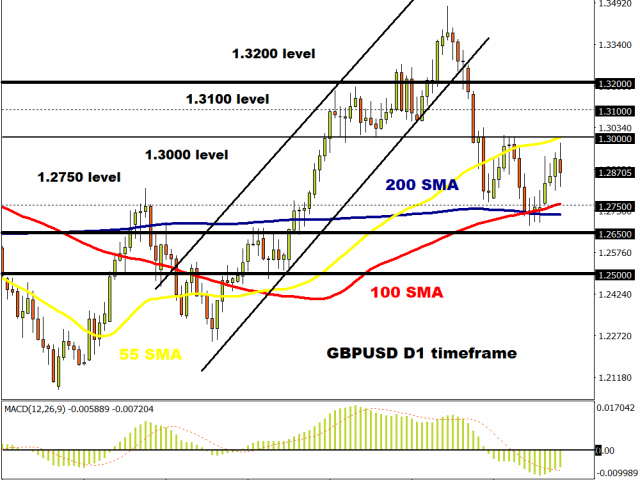

It’s been a typical rollercoaster ride of Brexit headlines today with both positive and more downbeat sources on the wires concerning the last two negotiating issues on state aid and fishing rights. The EU said they will begin legal proceedings over the UK’s Internal Market Bill just to rachet up any forgotten tensions! A letter of ‘formal notice’ to UK means they will have a month to respond, though Boris’ informal deadline for negotiations comes before that in mid-October.

Cable’s 3.5% drop last month looks to be continuing today with the 55-day Moving Average again capping the upside. Losses need to make their way past 1.28 to have any chance of pushing further south, otherwise the pair may see range trading in the next few sessions.

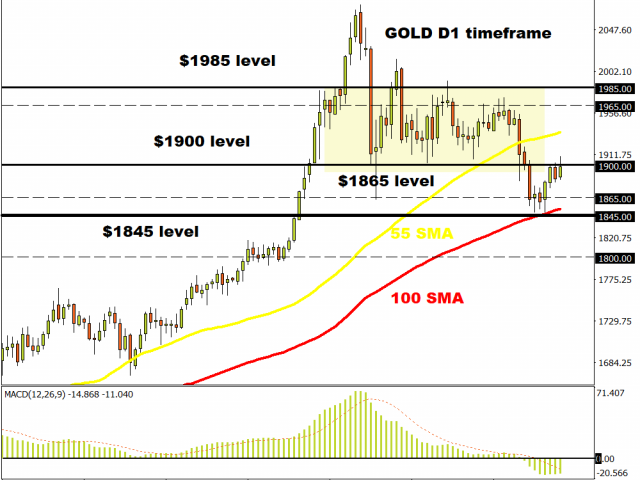

Gold toying with $1900

The shiny one has been on the sidelines in recent weeks after all-time highs made back in August. It’s trying its best to conclusively break above the psychological $1900 barrier but like the last two days, it’s finding it a struggle. Where the Dollar goes, so gold normally travels in the other direction, which means the new stimulus package and risk sentiment are key for near-term direction.

The 100-day Moving Average around $1852 supported prices very well last week, while the stubborn $1900 level needs to be beaten before Gold can challenge the 55-Day MA at $1937.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經