A sense of stability returned to financial markets on Thursday after big bazookas from central banks slightly soothed fears over the coronavirus outbreak and global economy.

The European Central Bank (ECB) went all out by launching a mammoth €750 billion Pandemic Emergency Purchase Programme (PEPP) to calm markets and help the Eurozone economy. Down under, the Reserve Bank of Australia cut its official cash rate to a fresh historic low of 0.25% to cushion the economic impact of the coronavirus pandemic. South Africa’s central bank also pulled the monetary policy trigger by reducing the repo rate by 1% to 5.25%.

Even in the United Kingdom, the Bank of England cut interest rates to 0.1%, in a second emergency cut triggered by the coronavirus fuelled market chaos.

Repeated intervention from global central banks may offer a temporary lifeline to equities. However, fears revolving around the coronavirus and how badly it will hit global growth should limit appetite for riskier assets.

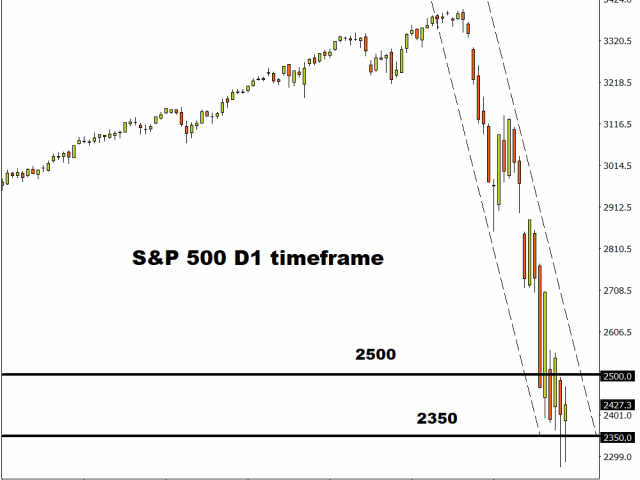

The S&P 500 attempted to stabilize on Thursday as prices kept above 2400. The improving market mood may encourage a move towards 2500 in the short term. If markets wake on the wrong side of the bed tomorrow, then prices could sink back below 2350.

Oil rebounds 20% as central banks fire away

Oil prices roared back to life on Thursday, bouncing off their lowest levels in 20 years as investors digested central bank and government support measures to support economic growth.

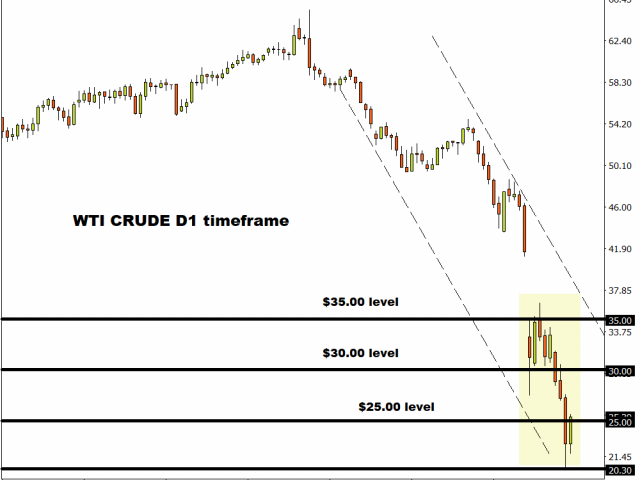

WTI Crude has appreciated almost 20% its multi-year lows and could extend gains in the short term amid stimulus hopes. While a technical rebound is on the cards, the fundamentals still remain in favour of bears. For as long as demand fears and oversupply concerns remain dominant themes, Oil is positioned to weaken further.

Looking at the technical picture, WTI Oil may rebound towards $30 in the short term before bears re-enter the scene.

Currency spotlight – EURUSD

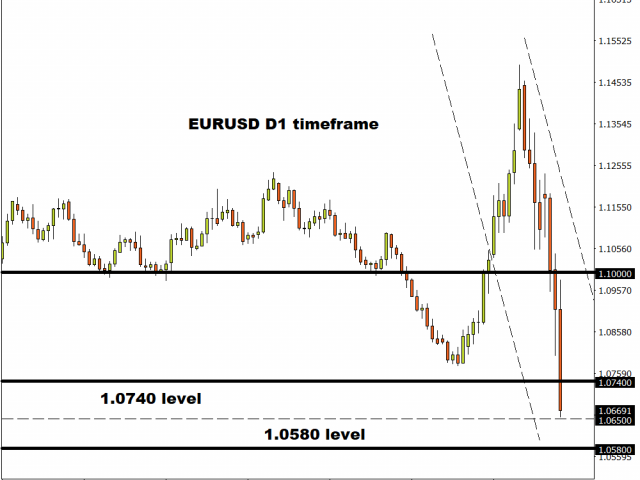

The EURUSD is falling like a stone thrown into the ocean with no real floor in sight.

Euro has weakened against every single G10 currency, shedding over 2% against the Dollar despite the ECB launching a big bazooka.

Prices are heavily bearish on the daily charts as there have been consistently lower lows and lower highs. A solid daily close below 1.0650 should open the doors towards 1.0580.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經