Our currency spotlight this week shines on the British Pound which has woken up on the right side of the bed this morning!

Investor sentiment towards the currency continues to turn increasingly positive, despite the UK officially entering a recession for the first time in 11 years. Although Brexit related uncertainty and drama remain recurrent themes, there seems to be some complacency in the markets and this continues to be reflected in the Pound’s valuation. With the risk of a hard Brexit growing by the day as negotiations stall, the longer-term outlook for the British Pound still points to further downside.

However, the short to medium-term outlook illustrates a more encouraging picture with bulls in the driving seat. It looks Sterling continues to derive strength from not only a broadly weaker Dollar but the Bank of England’s overly optimistic economic forecasts.

Pound bulls set sights on 1.3200

The GBPUSD remains firmly bullish on the weekly and daily timeframe with the currency pair trading around 1.3160 as of writing. Prices have jumped over 1000 pips since the start of May and have the potential to push higher once 1.3200 is conquered.

A solid weekly close above the 1.3200 resistance level could encourage a move towards 1.3400.

Taking a look at the daily timeframe, the GBPUSD remains in a wide 200 pip range with support at 1.3000 and resistance at 1.3200. A solid daily close above 1.3200 could trigger an incline towards 1.3300. Lagging indicators in the form of the 20 and 200 Simple Moving Averages and MACD marry the bullish setup.

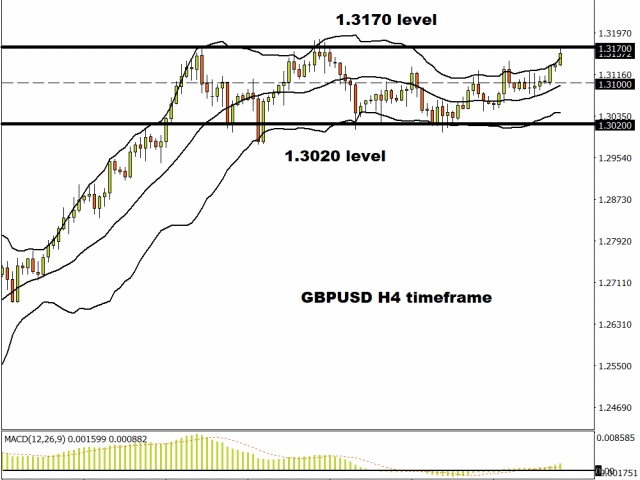

Looking at the four-hourly timeframe, it’s the same story here. Prices are rangebound with minor resistance at 1.3170 and minor support at 1.3020. If prices are unable to push higher, a decline back towards the 1.3100 pivotal level could be on the cards before bull retry their luck in challenging 1.3200.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經