Apple Inc. is perhaps the world’s most recognizable consumer technology brand with a stock market valuation beyond $1 trillion.

The tech giant’s domineering presence has certainly influenced different geographies ultimately becoming an important part of many people’s lives. While the outlook for Apple looks highly encouraging with the company shares gaining more than 6% since the start of the year, it remains uncertain whether first-quarter earnings will paint a similar picture.

Revenue is projected to come in at $88.5 billion, topping $84.3 billion in revenue during the same period a year earlier. Earnings are seen rising to $4.54 per share, compared to the $4.18 per share earned in the same period last year.

The argument for earnings to smash market forecasts revolve around bullish expectations for new iPhones, rising AirPod demand and growing momentum in Apple’s digital services. However, the coronavirus outbreak in China could throw a proverbial wrench into the works, especially if it results in supply chain disruptions and drop in demand.

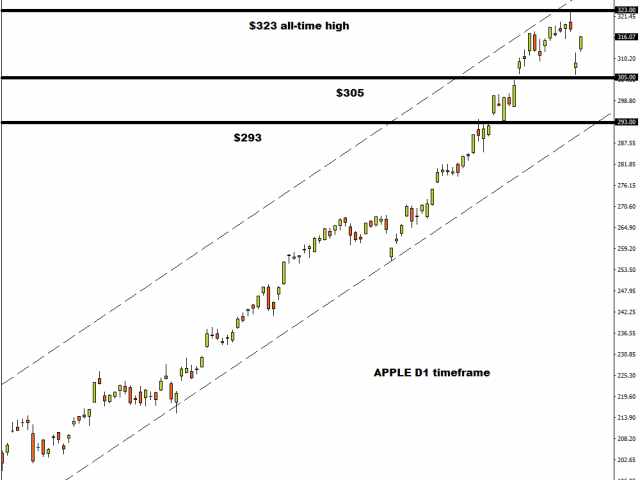

Taking a look at the technical picture, Apple shares are heavily bullish on the daily charts. There have been consistently higher highs and higher lows with prices roughly $10 away from the all-time high of $323. If the company’s earnings dish out an upside surprise, shares are likely to push higher with $323 acting as the first point of interest. A breakout above this all-time high may open the doors towards $350.

Alternatively, a disappointing set of earnings will most likely dent buying sentiment towards Amazon stock with prices seen dipping back towards $305.

It’s earnings time for Tesla

Tesla Inc. stock is slated to remain on standby as investors await the company’s Q4 and full-year results on Wednesday.

Market optimism over the company’s performance, strong international growth and profitability supported buying sentiment towards Tesla shares. While the future looks bright for the automotive and energy company, this needs to be reflected in earnings and revenues.

Wall Street expects Tesla to report a $1.62 per share gain for Q4 2019 while total revenues are forecast to hit $7 billion in the fourth quarter of 2019 compared to the $6.3 billion in the third quarter.

The technical picture remains in favour of bulls with prices trading roughly $30 away from the all-time high of $594.50 as of writing. A strong set of earnings could turbocharge Tesla shares with the first point of interest at $594.50 and potentially higher. Should the earnings disappoint, shares could sink back towards $538.50.

MyFxtops 邁投 (www.myfxtops.com) -Reliable Forex Copy Trade community, follow the master for free to trade!

Disclaimer: This article is reproduced from the Internet. If there is any infringement, please contact us to delete it immediately. In addition: This article only represents the personal opinion of the author and has nothing to do with Mato Finance The originality and the text and content stated in this article have not been confirmed by this site. The authenticity, completeness and timeliness of this article and all or part of the content and text are not guaranteed or promised. Please refer to it for reference only Verify the content yourself.

Copyright belongs to the author.

For commercial reprints, please contact the author for authorization. For non-commercial reprints, please indicate the source.

MyFxTops邁投財經

MyFxTops邁投財經